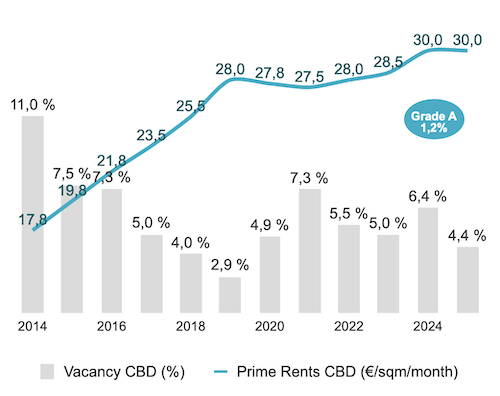

Barcelona – Rental Market

In the Barcelona market, take‑up in the CBD grew by 176% compared to the same period of the previous year. This phenomenon was partly due to the signing of 14,000 sqm in a single significant transaction. The vacancy rate for CBD offices fell to 4.4%, while Grade A offices stood at 1.2%. Prime rents remained at €30/sqm/month (€30/sqm/month at December 2024).

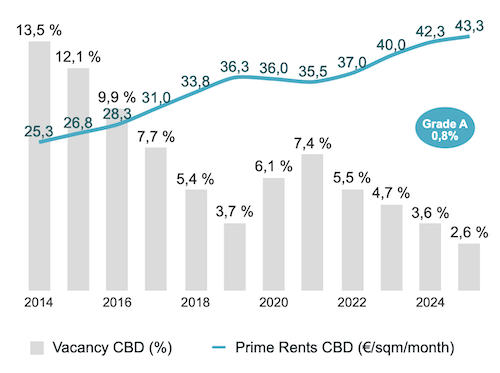

Madrid– Rental Market

Take‑up in the Madrid offices market reached 253,650 sqm in the first half of 2025 (up 2% compared to the first half of 2024). Take‑up in the CBD totaled 77,228 sqm. The vacancy rate in the CBD stood at 2.6%, marking a 10‑year low. The scarcity of available space increased prime rents to €43.25/sqm/month (€42.25/sqm/month at December 2024).

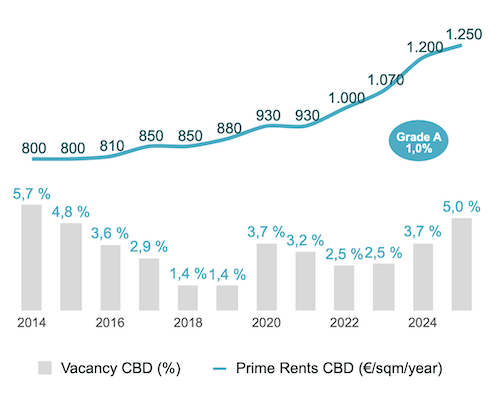

Paris – Rental Market

Take‑up in Paris reached 768,400 sqm in the first half of 2025, of which 156,897 sqm were in the CBD area, with demand remaining at similar levels to the previous year, showing a slight correction of 1%. The vacancy rate in the CBD stood at 5%, with Grade A asset availability at 1%. Prime rents for the best buildings in the CBD stood at €1,250/sqm/year (€1,200/sqm/year at December 2024).