Group Key Portfolio Metrics

| Group GAV 06/2025 | €11,86 €m |

| # of assets | 61 Spain 17 France |

| Total Surface |

1,624,920 sq m |

| Total EPRA Vacancy | 5% |

Capital Structure Metrics

| Market Capitalization(2) | €3,60 bm |

| Recurring earnings Jun.-25 | €249 m |

| Net Tangible Assets (NAV) 06/2025 (€/share) | 9.60 €/share |

| Group LTV(3) | 36.6% |

| Investment Grade Rating | BBB+ Stable by S&P Baa1 by Moody's |

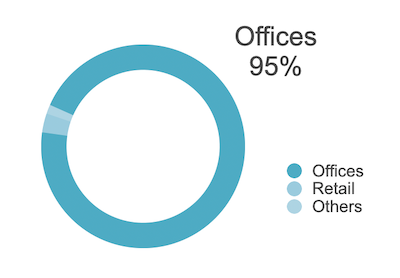

Business Mix

GAV del grupo

Colonial's strategy has clearly decided by the office market, assuming 95% of its total business.

The business model is located development, rehabilitation and operation of high quality offices in prime locations, mainly the CBD (Central Business District).

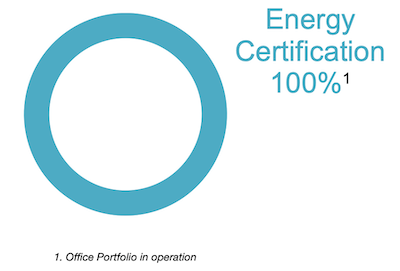

The Colonial Group aims to work on improving energy efficiency based on energy certification processes in order to implement continuous improvement processes in buildings.

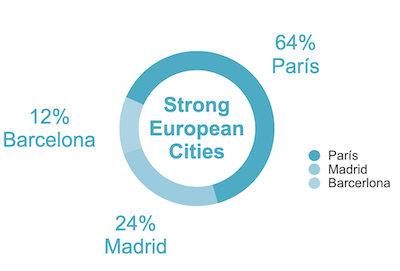

A pan-European strategy diversified markets offices in Barcelona, Madrid and Paris.

References

- EPRA vacancy:financial vacancy according to the calculation recommended by EPRA (1-[Vacant floorspace multiplied by the market rent/operational floorspace at market rent])

- At June 30, 2025

- Net debt Group /GAV Group