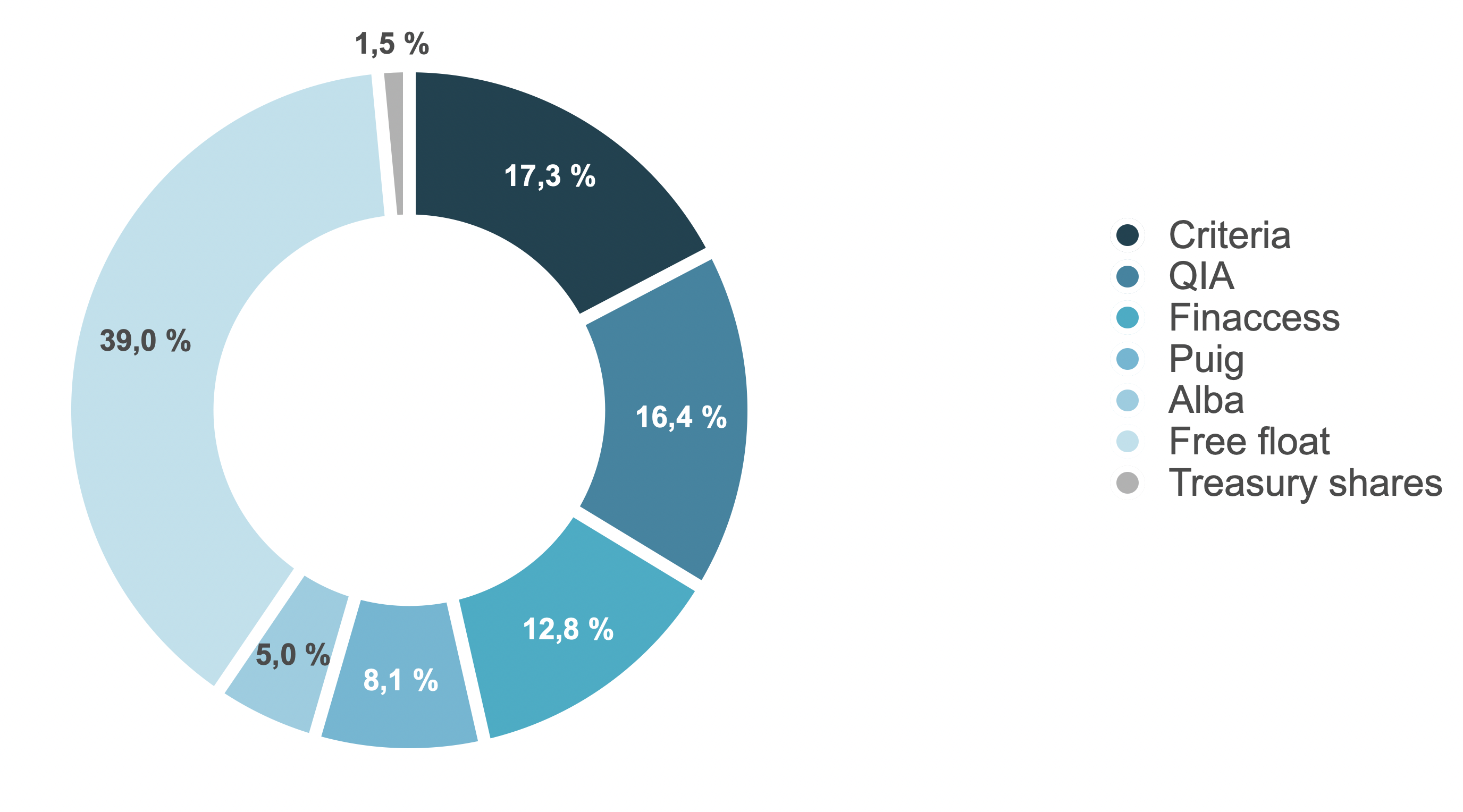

Shareholder structure

Data according to the CNMV communications and communications received by the company.

(*) According to reports in the CNMV and notifications received by the Company.

(1) Mr. Carlos Fernández González controls the majority of the capital and voting rights of Grupo FarLuca, S.A. de C.V., entity that owns the majority of the capital and voting rights of Grupo Finaccess, S.A.P.I. de C.V., which owns 99.99% of the capital and voting rights of Finaccess Capital, S.A. de C.V., which controls the direct shareholders de Finaccess Inmobiliaria, S.L. (51%) and Finaccess Capital Inversores, S.L. (100%). The direct shareholders are therefore controlled by entities related to Mr. Carlos Fernández González and the percentage in the share capital thus controlled amounts to 14.83%.

On the other hand, Mr. Carlos Fernández González has a close relationship with Finaccess México, S.A. de C.V., Investment Funds Operating Company. This company owns an indirect share of 0.46% of the stock of Inmobiliaria Colonial, SOCIMI, S.A. The direct holder of the participation is Latin 10, S.A. de C.V., a fund independently managed by Finaccess Mexico, S.A. de C.V.

Shareholdings & Treasury shares

This information is available on the Comisión Nacional del Mercado de Valores (CNMV) website, where the company’s treasury share situation is described.

Capital Structure

Inmobiliaria Colonial’s share capital, following the most recent capital increase in July 2024, amounts to 1,568,361,717.50 euros, comprising 627,344,687 shares, each with a nominal value of 2.5 euro. All the shares are of the same class and series, represented by the book-entry method and are fully paid-up and subscribed. All the shares confer the same voting and financial rights.

The shares of Inmobiliaria Colonial, SOCIMI, S.A. they are listed on the Stock Exchanges of Madrid and Barcelona, in the segment corresponding to general contracting market trading.

Capital Performance

| Date | Operation | Nº Issued Shares | Nº Total Shares | Nominal per Share | New Share Capital |

|---|---|---|---|---|---|

| Jan. 2014 | Capital reduction | - | 225.918.690 | 0,25€ | 56.479.672,50€ |

| Jan. 2014 | Capital increase warrants conversion | 1.890 | 225.920.580 | 0,25€ | 56.480.145,00€ |

| Mar. 2014 | Capital increase warrants conversion | 79.101 | 225.999.681 | 0,25€ | 56.499.920,25€ |

| May. 2014 | Capital increase | 2.937.995.853 | 3.163.995.534 | 0,25€ | 790.998.883,50€ |

| May. 2014 | Capital increase warrants conversion | 1.944.444 | 3.165.939.978 | 0,25€ | 791.484.994,50€ |

| Dec. 2014 | Capital increase warrants conversion | 22.916.662 | 3.188.856.640 | 0,25€ | 797.214.160,00€ |

| Jun. 2016 | Capital increase | 90.805.920 | 3.279.662.560 | 0,25€ | 819.915.640€ |

| Jun. 2016 | Capital increase | 288.571.430 | 3.568.233.990 | 0,25€ | 892.058.497,50€ |

| Jul. 2016 | Contra-split | - | 356.823.399 | 2,5€ | 892.058.497,50€ |

| May. 2017 | Capital increase | 35.646.657 | 392.470.056 | 2,5€ | 981.175.140,00€ |

| Nov. 2017 | Capital increase | 42.847.300 | 435.317.356 | 2,5€ | 1.088.293.390,00€ |

| Jul. 2018 | Capital increase | 19.273.622 | 454.590.978 | 2,5€ | 1.136.477.445,00€ |

| Nov. 2018 | Capital increase | 53.523.803 | 508.114.781 | 2,5€ | 1.270.286.952,50€ |

| Ago. 2021 | Capital increase | 22.494.701 | 530.609.482 | 2,5€ | 1.326.523.705,00€ |

| Sep. 2021 | Capital increase | 9.006.155 | 539.615.637 | 2,5€ | 1.349.039.092,50€ |

Jun. 2024 | Capital increase | 87.729.050 | 87.729.050 | 2,5€ | 1.568.361.717,50€ |