Financial Information:

Colonial Share

Share capital

Shareholdings & Treasury shares

This information is available on the Comisión Nacional del Mercado de Valores (CNMV) website, where the company’s treasury share situation is described.

Capital Structure

Inmobiliaria Colonial’s share capital, following the most recent capital increase in July 2024, amounts to 1,568,361,717.50 euros, comprising 627,344,687 shares, each with a nominal value of 2.5 euro. All the shares are of the same class and series, represented by the book-entry method and are fully paid-up and subscribed. All the shares confer the same voting and financial rights.

The shares of Inmobiliaria Colonial, SOCIMI, S.A. they are listed on the Stock Exchanges of Madrid and Barcelona, in the segment corresponding to general contracting market trading.

Capital Performance

| Date | Operation | Nº Issued Shares | Nº Total Shares | Nominal per Share | New Share Capital |

|---|---|---|---|---|---|

| Jan. 2014 | Capital reduction | - | 225.918.690 | 0,25€ | 56.479.672,50€ |

| Jan. 2014 | Capital increase warrants conversion | 1.890 | 225.920.580 | 0,25€ | 56.480.145,00€ |

| Mar. 2014 | Capital increase warrants conversion | 79.101 | 225.999.681 | 0,25€ | 56.499.920,25€ |

| May. 2014 | Capital increase | 2.937.995.853 | 3.163.995.534 | 0,25€ | 790.998.883,50€ |

| May. 2014 | Capital increase warrants conversion | 1.944.444 | 3.165.939.978 | 0,25€ | 791.484.994,50€ |

| Dec. 2014 | Capital increase warrants conversion | 22.916.662 | 3.188.856.640 | 0,25€ | 797.214.160,00€ |

| Jun. 2016 | Capital increase | 90.805.920 | 3.279.662.560 | 0,25€ | 819.915.640€ |

| Jun. 2016 | Capital increase | 288.571.430 | 3.568.233.990 | 0,25€ | 892.058.497,50€ |

| Jul. 2016 | Contra-split | - | 356.823.399 | 2,5€ | 892.058.497,50€ |

| May. 2017 | Capital increase | 35.646.657 | 392.470.056 | 2,5€ | 981.175.140,00€ |

| Nov. 2017 | Capital increase | 42.847.300 | 435.317.356 | 2,5€ | 1.088.293.390,00€ |

| Jul. 2018 | Capital increase | 19.273.622 | 454.590.978 | 2,5€ | 1.136.477.445,00€ |

| Nov. 2018 | Capital increase | 53.523.803 | 508.114.781 | 2,5€ | 1.270.286.952,50€ |

| Ago. 2021 | Capital increase | 22.494.701 | 530.609.482 | 2,5€ | 1.326.523.705,00€ |

| Sep. 2021 | Capital increase | 9.006.155 | 539.615.637 | 2,5€ | 1.349.039.092,50€ |

Jun. 2024 | Capital increase | 87.729.050 | 87.729.050 | 2,5€ | 1.568.361.717,50€ |

Shareholding

Shareholder structure

Data according to the CNMV communications and communications received by the company.

(*) According to reports in the CNMV and notifications received by the Company.

(1) Mr. Carlos Fernández González controls the majority of the capital and voting rights of Grupo FarLuca, S.A. de C.V., entity that owns the majority of the capital and voting rights of Grupo Finaccess, S.A.P.I. de C.V., which owns 99.99% of the capital and voting rights of Finaccess Capital, S.A. de C.V., which controls the direct shareholders de Finaccess Inmobiliaria, S.L. (51%) and Finaccess Capital Inversores, S.L. (100%). The direct shareholders are therefore controlled by entities related to Mr. Carlos Fernández González and the percentage in the share capital thus controlled amounts to 14.83%.

On the other hand, Mr. Carlos Fernández González has a close relationship with Finaccess México, S.A. de C.V., Investment Funds Operating Company. This company owns an indirect share of 0.46% of the stock of Inmobiliaria Colonial, SOCIMI, S.A. The direct holder of the participation is Latin 10, S.A. de C.V., a fund independently managed by Finaccess Mexico, S.A. de C.V.

The dividend distribution policy and the amount is set by the General Meeting of shareholders of the Company proposed by the Board of Directors.Currently, the Company has not established a dividend policy.

In connection with the resolution adopted under item two of today’s General Shareholders’ Meeting’s agenda regarding the distribution to shareholders of a cash dividend (the “Dividend”), the Board of Directors of the Company has resolved to pay it in the terms set forth below:

- Gross amount to be distributed: 0.30 euros per share.

- Last trading date on which the shares will be traded with the right to receive the Dividend (last trading date): 16 June 2025.

- Date as of which the shares will be traded without the right to receive the Dividend (ex-date): 17 June 2025.

- Date of determination of the shareholders with the right to receive the Dividend (record date): 18 June 2025.

- Date on which the Dividend is paid (payment date): 19 June 2025.

Key figures

Historical series

The following table shows the time series of the key items for the útimos five years magnitudes are exposed.

Kindly you download a large version of Excel:

| Barcelona | 2024 | 2023 | 2022 | 2021 | 2020 |

|---|---|---|---|---|---|

| Physical Offices Occupancy (%) | 77% | 80% | 78% | 90% | 95% |

| Rental revenues (€m) | 47 | 46 | 48 | 44 | 49 |

| Net Rental Income (€m) | 40 | 40 | 42 | 39 | 47 |

| NRI / Rental revenues (%) | 85% | 87% | 87% | 88% | 95% |

| Madrid | 2024 | 2023 | 2022 | 2021 | 2020 |

|---|---|---|---|---|---|

| Physical Offices Occupancy (%) | 91% | 97% | 96% | 93% | 96% |

| Rental revenues (€m) | 89 | 96 | 102 | 95 | 103 |

| Net Rental Income (€m) | 81 | 90 | 90 | 86 | 94 |

| NRI / Rental revenues (%) | 91% | 93% | 88% | 90% | 91% |

| París | 2024 | 2023 | 2022 | 2021 | 2020 |

|---|---|---|---|---|---|

| Physical Offices Occupancy (%) | 100% | 100% | 100% | 98% | 93% |

| Rental revenues (€m) | 254 | 234 | 205 | 175 | 180 |

| Net Rental Income (€m) | 247 | 223 | 194 | 168 | 172 |

| NRI / Rental revenues (%) | 97% | 95% | 95% | 96% | 95% |

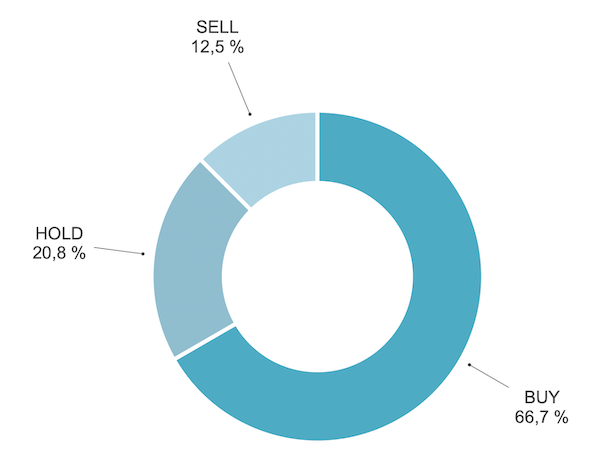

Analyst research

Tracking the action of Colonial

| Institution | Analyst | Date | Recommendation | Target Price (€/share) |

|---|---|---|---|---|

BUY | ||||

| Intermoney Valores | Guillermo Barrio | 9/7/2025 | Buy | 8,5 |

| Renta 4 SAB | Javier Diaz | 25/7/2025 | Overweight | 8,5 |

| CaixaBank BPI | Tomás Reis | 24/7/2025 | Buy | 8,1 |

| Santander | Mariano Miguel | 23/4/2025 | Outperform | 8,1 |

| GVC Gaesco | Rafael Fernández | 08/9/2025 | Buy | 8,0 |

| JB Capital Markets | Ignacio Dominguez Ruiz | 25/7/2025 | Buy | 7,8 |

| Banco Sabadell | Ignacio Romero | 25/7/2025 | Buy | 7,8 |

| Citi | Aaron Guy | 24/7/2025 | Buy | 7,5 |

| Morgan Stanley | Ana Escalante | 01/9/2025 | Overweight | 7,5 |

| ALANTRA | Fernando Abril Martorell | 25/7/2025 | Buy | 7,1 |

| Bankinter | Juan Moreno | 29/7/2025 | Buy | 7,1 |

| Kepler | Benjamin Legrand | 25/7/2025 | Buy | 6,9 |

| ODDO BHF | Florent Laroche-Joubert | 24/7/2025 | Outperform | 6,8 |

| Bank of America | Markus Kulessa | 02/9/2025 | Buy | 6,7 |

| Kempen | Veronique Meertens | 25/7/2025 | Buy | 6,5 |

| Green Street | Adam Shapton | 02/6/2025 | Buy | n.a. |

HOLD | ||||

| J.P. Morgan | Neil Green | 10/9/2025 | Neutral | 7,2 |

| Bernstein SG | Valerie Jacob | 18/9/2025 | Neutral | 6,6 |

| Jefferies | Pierre-Emmanuel Clouard | 28/7/2025 | Hold | 6,4 |

| Exane BNP Paribas | Gonzalo de Cueto | 10/9/2025 | Neutral | 6,1 |

| Deutsche Bank | Thomas Rothaeusler | 25/7/2025 | Hold | 6,0 |

SELL | ||||

| Barclays | Celine Soo-Huynh | 15/8/2025 | Underweight | 5,4 |

| Goldman Sachs | Jonathan Kownator | 08/9/2025 | Sell | 54,8 |

| Baader / AlphaValue | Christian Auzanneau | 24/7/2025 | Sell | 4,3 |

Source: Bloomberg & analyst reports

Average supplier payment period

The average payment period to suppliers of Inmobiliaria Colonial, SOCIMI, S.A. in 2024 was 38 days, below the legal maximum of 60 days established by Law 31/2014, of December, on combating late payment in commercial transactions. The average payment period was calculated in accordance with the provisions of this law.